Page 36 - Estimates of Public Entities Revenue & Expenditure 2023

P. 36

PROVINCE OF THE EASTERN CAPE ESTIMATES OF PUBLIC ENTITIES REVENUE AND EXPENDITURE 2023/24

• The education and awareness intervention initiatives contribute to ensuring that members of the

community are effectively and meaningfully educated on responsible consumption of alcohol so

that the high rate of excessive consumption of alcohol is considerably reduced in the Eastern

Cape. In order to enhance the education of communities on the scourge of alcohol abuse, various

focus areas have been identified such as underage, communities, road users, and FAS (pregnant

women).

• The entity will further conduct evaluation assessments to evaluate the impact of the social

accountability interventions and implementation.

9. Expenditure Estimates

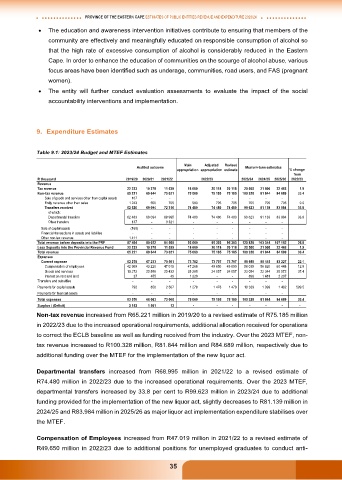

Table 9.1: 2023/24 Budget and MTEF Estimates

Audited outcome Main Adjusted Revised Medium-term estimates

appropriation appropriation estimate % change

from

R thousand 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 2022/23

Revenue

Tax revenue 22 233 10 378 11 539 18 600 20 118 20 118 20 500 21 500 22 463 1.9

Non-tax revenue 65 221 69 644 73 021 75 060 75 185 75 185 100 328 81 844 84 689 33.4

Sale of goods and services other than capital assets 107 - - - - - - - -

Entity revenue other than sales 1 243 550 705 580 705 705 705 705 705 0.0

Transfers received 62 620 69 094 72 316 74 480 74 480 74 480 99 623 81 139 83 984 33.8

of which:

Departmental transfers 62 483 69 094 68 995 74 480 74 480 74 480 99 623 81 139 83 984 33.8

Other transfers 137 - 3 321 - - - - - -

Sale of capital assets (160) - - - - - - - -

Financial transactions in assets and liabilities - - - - - - - - -

Other non-tax revenue 1 411 - - - - - - - -

Total revenue before deposits into the PRF 87 454 80 022 84 560 93 660 95 303 95 303 120 828 103 344 107 152 26.8

Less Deposits into the Provincial Revenue Fund 22 233 10 378 11 539 18 600 20 118 20 118 20 500 21 500 22 463 1.9

Total revenue 65 221 69 644 73 021 75 060 75 185 75 185 100 328 81 844 84 689 33.4

Expenses

Current expense 62 278 67 233 70 501 73 782 73 707 73 707 89 989 80 445 83 227 22.1

Compensation of employees 42 969 43 220 47 019 47 268 49 650 49 650 56 039 56 620 60 448 12.9

Goods and services 19 272 23 558 23 433 25 285 24 057 24 057 33 054 22 344 20 572 37.4

Interest on rent and land 37 455 49 1 229 - - 896 1 481 2 207

Transfers and subsidies - - - - - - - - -

Payments for capital assets 792 850 2 507 1 278 1 478 1 478 10 339 1 399 1 462 599.5

Payments for financial assets - - - - - - - - -

Total expenses 63 070 68 083 73 008 75 060 75 185 75 185 100 328 81 844 84 689 33.4

Surplus / (Deficit) 2 152 1 561 13 - - - - - - -

Non-tax revenue increased from R65.221 million in 2019/20 to a revised estimate of R75.185 million

in 2022/23 due to the increased operational requirements, additional allocation received for operations

to correct the ECLB baseline as well as funding received from the industry. Over the 2023 MTEF, non-

tax revenue increased to R100.328 million, R81.844 million and R84.689 million, respectively due to

additional funding over the MTEF for the implementation of the new liquor act.

Departmental transfers increased from R68.995 million in 2021/22 to a revised estimate of

R74.480 million in 2022/23 due to the increased operational requirements. Over the 2023 MTEF,

departmental transfers increased by 33.8 per cent to R99.623 million in 2023/24 due to additional

funding provided for the implementation of the new liquor act, slightly decreases to R81.139 million in

2024/25 and R83.984 million in 2025/26 as major liquor act implementation expenditure stabilises over

the MTEF.

Compensation of Employees increased from R47.019 million in 2021/22 to a revised estimate of

R49.650 million in 2022/23 due to additional positions for unemployed graduates to conduct anti-

35