Page 77 - Estimates of Public Entities Revenue & Expenditure 2023

P. 77

PROVINCE OF THE EASTERN CAPE ESTIMATES OF PUBLIC ENTITIES REVENUE AND EXPENDITURE 2023/24

• Implementation of the African Continental Free Trade Agreement (AfCFTA) is expected to

significantly shape foreign investment into African special economic zones. It is also likely to affect

target industries and source countries of investment.

• ELIDZ may need to consider showcasing its ability to give strategic opportunity insights to potential

investors on the AfCFTA opportunities.

• ELIDZ will have to focus on strategic investment promotion and facilitation activities whilst building

a strategic pipeline of bankable projects. This includes Instruments to leverage public sector

finance to mobilize private funds for its packaged catalytic projects.

• Continue intensifying efforts to raise funds for capital projects in the following sectors: aqua

culture, automotive incubation and renewable energy and ICT.

• Follow up on the application for the designation of additional parcels of land to accommodate the

additional sectors and investors.

• Continue with the electrical upgrade project that would ensure that ELIDZ electricity supply would

move from 20MVA to 40 MVA capacity; and this would ensure uninterrupted supply of electricity

to current and future investors. Phase 1 of the project is complete. The organization is looking

into starting phase 2.

• The ELIDZ will also focus on development of 10 smaller manufacturing facilities ranging from 800

to 1,500sqm to accommodate SMEs looking to expand into the formal manufacturing space.

These units will also accommodate Automotive Incubator graduates who are pursuant to offering

their products in the automotive sector; and

• Promote the SEZ incentives approved by National Treasury to investors and prospective

investors located in the zone.

9. Expenditure Estimates

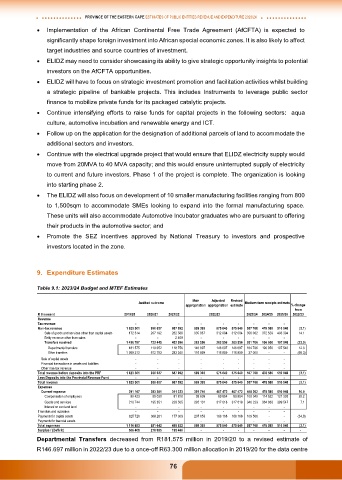

Table 9.1: 2023/24 Budget and MTEF Estimates

Main Adjusted Revised

Audited outcome Medium-term receipts estimate

appropriation appropriation estimate % change

from

R thousand 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 2022/23

Revenue

Tax revenue - - - - - - - - -

Non-tax revenue 1 623 301 930 637 687 092 599 393 575 640 575 640 557 768 478 585 510 940 (3.1)

Sale of goods and services other than capital assets 172 514 207 192 282 588 335 837 312 084 312 084 356 062 372 529 403 394 14.1

Entity revenue other than sales - - 2 409 - - - - - -

1 450 787

Transfers received - - 402 096 263 556 263 556 263 556 201 706 106 056 107 546 (23.5)

723 445

of which:

-

-

-

- - -

-

Departmental transfers 181 575 110 652 118 756 146 697 146 697 146 697 164 706 106 056 107 546 12.3

Other transfers 1 269 212 612 793 283 340 116 859 116 859 116 859 37 000 - - (68.3)

Sale of capital assets - - - - - - - - -

Financial transactions in assets and liabilities - - - - - - - - -

Other non-tax revenue - - - - - - - - -

Total revenue before deposits into the PRF 1 623 301 930 637 687 092 599 393 575 640 575 640 557 768 478 585 510 940 (3.1)

Less Deposits into the Provincial Revenue Fund - - - - - - - - -

Total revenue 1 623 301 930 637 687 092 599 393 575 640 575 640 557 768 478 585 510 940 (3.1)

Expenses

Current expense 291 167 283 381 311 323 391 740 407 472 407 472 448 262 478 585 510 940 10.0

Compensation of employees 80 423 88 030 81 818 99 609 89 854 89 854 108 040 114 522 121 393 20.2

Goods and services 210 744 195 351 229 505 292 131 317 618 317 618 340 223 364 063 389 547 7.1

Interest on rent and land - - - - - - - - -

Transfers and subsidies - - - - - - - - -

Payments for capital assets 825 726 368 261 177 309 207 653 168 168 168 168 109 506 - - (34.9)

Payments for financial assets - - - - - - - - -

Total expenses 1 116 893 651 642 488 632 599 393 575 640 575 640 557 768 478 585 510 940 (3.1)

Surplus / (Deficit) 506 408 278 995 198 460 - - - - - - -

Departmental Transfers decreased from R181.575 million in 2019/20 to a revised estimate of

R146.697 million in 2022/23 due to a once-off R63.300 million allocation in 2019/20 for the data centre

76