Page 91 - Estimates of Public Entities Revenue & Expenditure 2023

P. 91

PROVINCE OF THE EASTERN CAPE ESTIMATES OF PUBLIC ENTITIES REVENUE AND EXPENDITURE 2023/24

Inflation is expected to average at 6.7 per cent for 2022 and decline to average 5.1 per cent in 2023.

For the Coega SEZ to pursue its vision to become a catalyst for the championing of socio-economic

development in the region and the country, the support of the Government through the Department of

Trade Industry and Competition (the dtic) and Eastern Cape Provincial Government is required. The

legislative environment has continued to support CDC’s strategic objectives as set out in the

Sustainable Growth Strategy 2020. It is expected that the legislative environment will continue to be

conducive in supporting the SEZ development for the next strategic cycle 2021-2025, the “Growth &

Sustainable Development Strategy.”

The Impact Statements and Outcomes of this strategic cycle include Financial Sustainability,

Increased Strategic Economic Advantage for Targeted Industries, and Increased Economic

Opportunities for the marginalised. Achieving these Impact Statements and Outcomes would enable

the CDC to improve investment attraction, retention of operational investors and customer satisfaction,

thus continuing to deliver customer and shareholder value.

The Coega SEZ will continue to strive to be a prime investment destination in South Africa and the

African Continent.

9. Expenditure Estimates

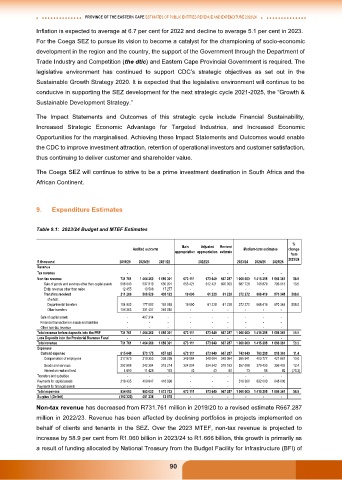

Table 9.1: 2023/24 Budget and MTEF Estimates

%

Audited outcome Main Adjusted Revised Medium-term estimates change

appropriation appropriation estimate from

2023/24

R thousand 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26

Revenue

Tax revenue - - - - - - - - -

Non-tax revenue 731 761 1 464 260 1 086 301 673 111 673 649 667 287 1 060 000 1 415 298 1 666 361 58.9

Sale of goods and services other than capital assets 508 040 537 819 630 901 653 421 612 421 606 059 687 728 746 879 796 013 13.5

Entity revenue other than sales 12 455 10 598 17 277 - - - - - -

Transfers received 211 266 508 529 438 123 19 690 61 228 61 228 372 272 668 419 870 348 508.0

of which:

Departmental transfers 104 903 177 092 192 093 19 690 61 228 61 228 372 272 668 419 870 348 508.0

Other transfers 106 363 331 437 246 030 - - - - - -

Sale of capital assets - 407 314 - - - - - - -

Financial transactions in assets and liabilities - - - - - - - - -

Other non-tax revenue - - - - - - - - -

Total revenue before deposits into the PRF 731 761 1 464 260 1 086 301 673 111 673 649 667 287 1 060 000 1 415 298 1 666 361 58.9

Less Deposits into the Provincial Revenue Fund - - - - - - - - -

Total revenue 731 761 1 464 260 1 086 301 673 111 673 649 667 287 1 060 000 1 415 298 1 666 361 58.9

Expenses

Current expense 615 648 573 175 657 625 673 111 673 649 667 287 743 640 783 298 818 361 11.4

Compensation of employees 317 970 319 353 338 258 349 064 349 064 349 064 385 941 403 777 421 867 10.6

Goods and services 292 988 242 394 319 214 324 004 324 542 318 163 357 686 379 433 396 402 12.4

Interest on rent and land 4 690 11 428 153 43 43 60 13 88 92 (78.3)

Transfers and subsidies - - - - - - - - -

Payments for capital assets 218 435 409 847 416 098 - - - 316 360 632 000 848 000

Payments for financial assets - - - - - - - - -

Total expenses 834 083 983 022 1 073 723 673 111 673 649 667 287 1 060 000 1 415 298 1 666 361 58.9

Surplus / (Deficit) (102 322) 481 238 12 578 - - - - - -

Non-tax revenue has decreased from R731.761 million in 2019/20 to a revised estimate R667.287

million in 2022/23. Revenue has been affected by declining portfolios in projects implemented on

behalf of clients and tenants in the SEZ. Over the 2023 MTEF, non-tax revenue is projected to

increase by 58.9 per cent from R1.060 billion in 2023/24 to R1.666 billion, this growth is primarily as

a result of funding allocated by National Treasury from the Budget Facility for Infrastructure (BFI) of

90