Page 51 - Estimates of Public Entities Revenue & Expenditure 2023

P. 51

PROVINCE OF THE EASTERN CAPE ESTIMATES OF PUBLIC ENTITIES REVENUE AND EXPENDITURE 2023/24

ECPTA will continue to work towards a capable, ethical, and developmental state by:

• Retaining a clean audit status.

• Adopting an openly developmental approach to work in communities and with stakeholder

groups.

• Speeding up the transition to digital knowledge management (archiving / policy library / SOPs

etc.) to secure institutional memory linked to sound succession planning.

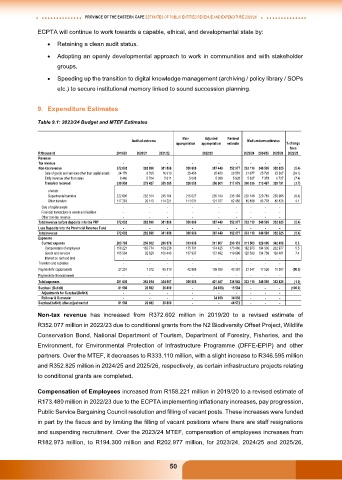

9. Expenditure Estimates

Table 9.1: 2023/24 Budget and MTEF Estimates

Main Adjusted Revised

Audited outcome Medium-term estimates

appropriation appropriation estimate % change

from

R thousand 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 2022/23

Revenue

Tax revenue - - - - - - - - -

Non-tax revenue 372 602 292 896 381 806 356 606 387 449 352 077 333 110 346 595 352 825 (5.4)

Sale of goods and services other than capital assets 24 178 8 765 16 810 25 450 25 450 28 570 21 677 25 720 25 307 (24.1)

Entity revenue other than sales 8 466 5 704 5 611 5 098 5 098 5 828 5 397 7 378 6 727 (7.4)

Transfers received 339 958 278 427 359 385 326 058 356 901 317 679 306 036 313 497 320 791 (3.7)

of which:

Departmental transfers 222 695 252 314 245 164 215 027 235 194 235 194 220 148 229 719 239 965 (6.4)

Other transfers 117 263 26 113 114 221 111 031 121 707 82 485 85 888 83 778 80 826 4.1

Sale of capital assets - - - - - - - - -

Financial transactions in assets and liabilities - - - - - - - - -

Other non-tax revenue - - - - - - - - -

Total revenue before deposits into the PRF 372 602 292 896 381 806 356 606 387 449 352 077 333 110 346 595 352 825 (5.4)

Less Deposits into the Provincial Revenue Fund - - - - - - - - -

Total revenue 372 602 292 896 381 806 356 606 387 449 352 077 333 110 346 595 352 825 (5.4)

Expenses

Current expense 263 785 256 602 269 678 313 638 311 907 293 176 311 563 329 069 342 458 6.3

Compensation of employees 158 221 163 774 169 238 175 701 174 425 173 480 182 973 194 300 202 977 5.5

Goods and services 105 564 92 828 100 440 137 937 137 482 119 696 128 590 134 769 139 481 7.4

Interest on rent and land - - - - - - - - -

Transfers and subsidies - - - - - - - - -

Payments for capital assets 27 251 7 312 85 319 42 968 109 580 43 367 21 547 17 526 10 367 (50.3)

Payments for financial assets - - - - - - - - -

Total expenses 291 036 263 914 354 997 356 606 421 487 336 543 333 110 346 595 352 825 (1.0)

Surplus / (Deficit) 81 566 28 982 26 809 - (34 038) 15 534 - - - (100.0)

Adjustments for Surplus/(Deficit) - - - - - - - - -

Rollover & Surrender - - - - 34 038 34 038 - - -

Surplus/(deficit) after adjustments1 81 566 28 982 26 809 - - 49 572 - - -

Non-tax revenue has increased from R372.602 million in 2019/20 to a revised estimate of

R352.077 million in 2022/23 due to conditional grants from the N2 Biodiversity Offset Project, Wildlife

Conservation Bond, National Department of Tourism, Department of Forestry, Fisheries, and the

Environment, for Environmental Protection of Infrastructure Programme (DFFE-EPIP) and other

partners. Over the MTEF, it decreases to R333.110 million, with a slight increase to R346.595 million

and R352.825 million in 2024/25 and 2025/26, respectively, as certain infrastructure projects relating

to conditional grants are completed.

Compensation of Employees increased from R158.221 million in 2019/20 to a revised estimate of

R173.480 million in 2022/23 due to the ECPTA implementing inflationary increases, pay progression,

Public Service Bargaining Council resolution and filling of vacant posts. These increases were funded

in part by the fiscus and by limiting the filling of vacant positions where there are staff resignations

and suspending recruitment. Over the 2023/24 MTEF, compensation of employees increases from

R182.973 million, to R194.300 million and R202.977 million, for 2023/24, 2024/25 and 2025/26,

50