Page 59 - Estimates of Public Entities Revenue & Expenditure 2023

P. 59

PROVINCE OF THE EASTERN CAPE ESTIMATES OF PUBLIC ENTITIES REVENUE AND EXPENDITURE 2023/24

• Rural Finance for Rural Development: Provide loans as part of funding for projects and rural

development interventions. Blended Finance Scheme project for the mobilisation of additional

finance towards sustainable development for Agri-entrepreneurs. Will support four priority

commodities with blended finance support; horticulture, red meat, grains, piggeries and poultry.

• Magwa-Majola: The entity will continue with the effort of attracting private investors to partner in

the development of the estate in high value cash crops; implementation of the Magwa-Majola

Master Plan which incorporates the agro-tourism component. An Investment Seminar is planned

for 16-17 March 2023 in an attempt to attract investors to Magwa-Majola to take advantage of

opportunities that exist in these estates i.e. Tourism, High value crops, Dairy, Cannabis Industry.

• Citrus intervention: Implement a customised support program for citrus producers in

partnership with commodity organisations.

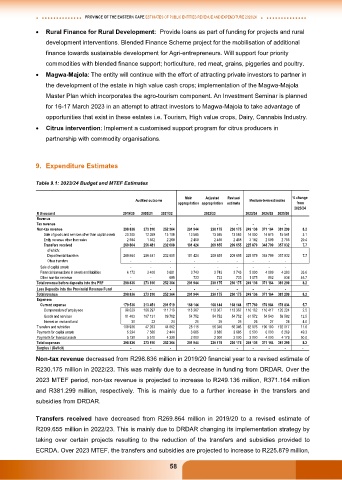

9. Expenditure Estimates

Table 9.1: 2023/24 Budget and MTEF Estimates

Audited outcome Main Adjusted Revised Medium-term estimates % change

appropriation appropriation estimate from

2023/24

R thousand 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26

Revenue

Tax revenue - - - - - - - - -

Non-tax revenue 298 836 273 810 252 364 201 944 230 175 230 175 249 136 371 164 381 299 8.2

Sale of goods and services other than capital assets 20 205 12 369 13 108 13 585 13 585 13 585 14 000 14 875 15 541 3.1

Entity revenue other than sales 2 594 1 552 2 268 2 458 2 458 2 458 3 182 2 589 2 705 29.4

Transfers received 269 864 256 481 232 608 181 424 209 655 209 655 225 879 348 799 357 932 7.7

of which:

Departmental transfers 269 864 256 481 232 608 181 424 209 655 209 655 225 879 348 799 357 932 7.7

Other transfers - - - - - - - - -

Sale of capital assets - - - - - - - - -

Financial transactions in assets and liabilities 6 173 3 408 3 681 3 743 3 743 3 743 5 000 4 099 4 283 33.6

Other non-tax revenue - - 699 733 733 733 1 075 802 838 46.7

Total revenue before deposits into the PRF 298 836 273 810 252 364 201 944 230 175 230 175 249 136 371 164 381 299 8.2

Less Deposits into the Provincial Revenue Fund - - - - - - - - -

Total revenue 298 836 273 810 252 364 201 944 230 175 230 175 249 136 371 164 381 299 8.2

Expenses

Current expense 179 536 213 451 201 519 168 144 168 144 168 144 177 760 170 984 178 834 5.7

Compensation of employees 98 023 106 297 111 713 113 367 113 367 113 367 116 162 116 417 120 224 2.5

Goods and services 81 483 107 131 89 782 54 752 54 752 54 752 61 572 54 540 58 582 12.5

Interest on rent and land 30 23 24 25 25 25 26 27 28 4.0

Transfers and subsidies 108 936 47 263 44 062 28 115 56 346 56 346 62 876 190 180 192 017 11.6

Payments for capital assets 5 234 7 586 2 444 3 685 3 685 3 685 5 500 6 000 6 269 49.3

Payments for financial assets 5 130 5 510 4 339 2 000 2 000 2 000 3 000 4 000 4 179 50.0

Total expenses 298 836 273 810 252 364 201 944 230 175 230 175 249 136 371 164 381 299 8.2

Surplus / (Deficit) - - - - - - - - - -

Non-tax revenue decreased from R298.836 million in 2019/20 financial year to a revised estimate of

R230.175 million in 2022/23. This was mainly due to a decrease in funding from DRDAR. Over the

2023 MTEF period, non-tax revenue is projected to increase to R249.136 million, R371.164 million

and R381.299 million, respectively. This is mainly due to a further increase in the transfers and

subsidies from DRDAR.

Transfers received have decreased from R269.864 million in 2019/20 to a revised estimate of

R209.655 million in 2022/23. This is mainly due to DRDAR changing its implementation strategy by

taking over certain projects resulting to the reduction of the transfers and subsidies provided to

ECRDA. Over 2023 MTEF, the transfers and subsidies are projected to increase to R225.879 million,

58