Page 84 - Estimates of Public Entities Revenue & Expenditure 2023

P. 84

PROVINCE OF THE EASTERN CAPE ESTIMATES OF PUBLIC ENTITIES REVENUE AND EXPENDITURE 2023/24

• The inadequate capacity for the finalisation of the organisational redesign project and the

implementation thereof.

• The change in system for the collection of revenue had caused a slight disturbance in the own

revenue collection targets.

• Due to the move of other programmes from administration offices to Depots, there has been a

critical need for Depo infrastructure upgrades to accommodate all MTC employees.

8. 2023/24 Performance outlook

The outlook for the 2023/24 financial year can be summarised as follows:

• To ensure that the implemented cashless automated fare collection system is fully functional,

and this is expected to increase revenue and a step towards a multi-mode transport payment

system;

• To expand the number of transportation contracts entered into with the MTC;

• To ensure the refurbishment of existing fleet within available resources;

• To Implement the Board Approved Revenue Improvement Strategy;

• The full implementation of the Organisational Redesign Program;

• Rebranding of the Corporation’s image entirely;

• Route coverage will be improved and increased and in so-doing increase own revenue; and

• The audit outcome on financial management will be improved towards a clean audit.

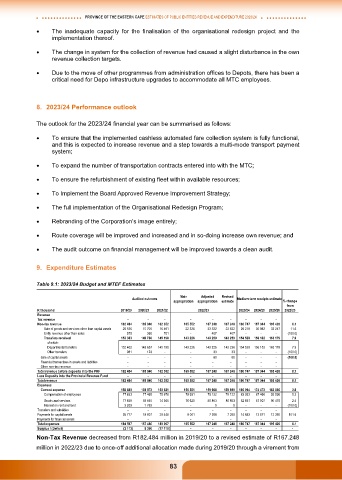

9. Expenditure Estimates

Table 9.1: 2023/24 Budget and MTEF Estimates

Main Adjusted Revised

Audited outcome Medium-term receipts estimate

appropriation appropriation estimate % change

from

R thousand 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 2022/23

Revenue

Tax revenue - - - - - - - - -

Non-tax revenue 182 484 165 840 162 352 165 552 167 248 167 248 180 747 187 044 195 426 8.1

Sale of goods and services other than capital assets 28 526 15 700 16 461 22 326 23 522 23 522 26 219 30 862 32 247 11.5

Entity revenue other than sales 575 360 701 - 407 407 - - - (100.0)

Transfers received 153 383 149 780 145 190 143 226 143 259 143 259 154 528 156 182 163 179 7.9

of which:

Departmental transfers 152 402 149 657 145 190 143 226 143 226 143 226 154 528 156 182 163 179 7.9

Other transfers 981 123 - - 33 33 - - - (100.0)

Sale of capital assets - - - - 60 60 - - - (100.0)

Financial transactions in assets and liabilities - - - - - - - - -

Other non-tax revenue - - - - - - - - -

Total revenue before deposits into the PRF 182 484 165 840 162 352 165 552 167 248 167 248 180 747 187 044 195 426 8.1

Less Deposits into the Provincial Revenue Fund - - - - - - - - -

Total revenue 182 484 165 840 162 352 165 552 167 248 167 248 180 747 187 044 195 426 8.1

Expenses

Current expense 158 880 138 873 150 621 156 551 159 980 159 980 166 094 174 473 183 066 3.8

Compensation of employees 77 833 77 465 75 676 79 931 79 122 79 122 83 263 87 466 92 596 5.2

Goods and services 77 838 59 645 74 945 76 620 80 853 80 853 82 831 87 007 90 470 2.4

Interest on rent and land 3 209 1 763 - - 5 5 - - - (100.0)

Transfers and subsidies - - - - - - - - -

Payments for capital assets 25 717 18 607 29 446 9 001 7 268 7 268 14 653 12 571 12 360 101.6

Payments for financial assets - - - - - - - - -

Total expenses 184 597 157 480 180 067 165 552 167 248 167 248 180 747 187 044 195 426 8.1

Surplus / (Deficit) (2 113) 8 360 (17 715) - - - - - - -

Non-Tax Revenue decreased from R182.484 million in 2019/20 to a revised estimate of R167.248

million in 2022/23 due to once-off additional allocation made during 2019/20 through a virement from

83