Page 119 - Provincial Treasury Estimates.pdf

P. 119

Estimates of the Provincial Revenue and Expenditure (EPRE) 2023/24 Financial Year

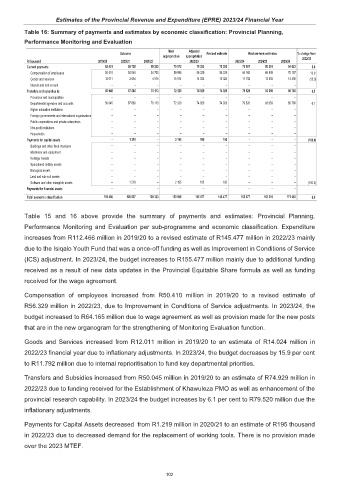

Table 16: Summary of payments and estimates by economic classification: Provincial Planning,

Performance Monitoring and Evaluation

Main Adjusted

Outcome Revised estimate Medium-term estimates % change from

appropriation appropriation 2022/23

R thousand 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26

Current payments 62 421 56 728 59 220 75 572 70 353 70 353 75 957 80 251 84 623 8.0

Compensation of employees 50 410 54 064 54 705 59 998 56 329 56 329 64 165 66 949 70 187 13.9

Goods and services 12 011 2 664 4 515 15 574 14 024 14 024 11 792 13 302 14 436 (15.9)

Interest and rent on land – – – – – – – – –

Transfers and subsidies to: 50 045 67 680 70 113 72 329 74 929 74 929 79 520 83 059 86 780 6.1

Provinces and municipalities – – – – – – – – –

Departmental agencies and accounts 50 045 67 680 70 113 72 329 74 929 74 929 79 520 83 059 86 780 6.1

Higher education institutions – – – – – – – – –

Foreign governments and international organisations – – – – – – – – –

Public corporations and private enterprises – – – – – – – – –

Non-profit institutions – – – – – – – – –

Households – – – – – – – – –

Payments for capital assets – 1 219 – 2 195 195 195 – – – (100.0)

Buildings and other fixed structures – – – – – – – – –

Machinery and equipment – – – – – – – – –

Heritage Assets – – – – – – – – –

Specialised military assets – – – – – – – – –

Biological assets – – – – – – – – –

Land and sub-soil assets – – – – – – – – –

Software and other intangible assets – 1 219 – 2 195 195 195 – – – (100.0)

Payments for financial assets – – – – – – – – –

Total economic classification 112 466 125 627 129 333 150 096 145 477 145 477 155 477 163 310 171 403 6.9

Table 15 and 16 above provide the summary of payments and estimates: Provincial Planning,

Performance Monitoring and Evaluation per sub-programme and economic classification. Expenditure

increases from R112.466 million in 2019/20 to a revised estimate of R145.477 million in 2022/23 mainly

due to the Isiqalo Youth Fund that was a once-off funding as well as Improvement in Conditions of Service

(ICS) adjustment. In 2023/24, the budget increases to R155.477 million mainly due to additional funding

received as a result of new data updates in the Provincial Equitable Share formula as well as funding

received for the wage agreement.

Compensation of employees increased from R50.410 million in 2019/20 to a revised estimate of

R56.329 million in 2022/23, due to Improvement in Conditions of Service adjustments. In 2023/24, the

budget increased to R64.165 million due to wage agreement as well as provision made for the new posts

that are in the new organogram for the strengthening of Monitoring Evaluation function.

Goods and Services increased from R12.011 million in 2019/20 to an estimate of R14.024 million in

2022/23 financial year due to inflationary adjustments. In 2023/24, the budget decreases by 15.9 per cent

to R11.792 million due to internal reprioritisation to fund key departmental priorities.

Transfers and Subsidies increased from R50.045 million in 2019/20 to an estimate of R74.929 million in

2022/23 due to funding received for the Establishment of Khawuleza PMO as well as enhancement of the

provincial research capability. In 2023/24 the budget increases by 6.1 per cent to R79.520 million due the

inflationary adjustments.

Payments for Capital Assets decreased from R1.219 million in 2020/21 to an estimate of R195 thousand

in 2022/23 due to decreased demand for the replacement of working tools. There is no provision made

over the 2023 MTEF.

102