Page 181 - Provincial Treasury Estimates.pdf

P. 181

Estimates of the Provincial Revenue and Expenditure (EPRE) – 2023/24 Financial Year

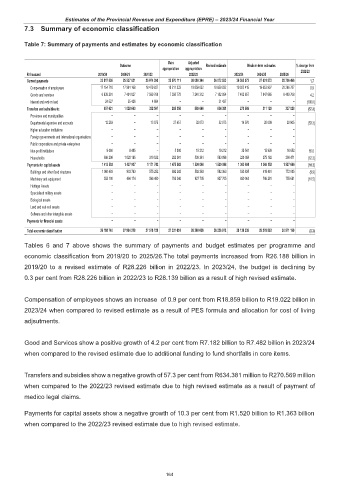

7.3 Summary of economic classification

Table 7: Summary of payments and estimates by economic classification

Main Adjusted

Outcome Revised estimate Medium-term estimates % change from

appropriation appropriation

R thousand 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 2022/23

Current payments 23 817 536 25 537 621 26 074 390 25 570 111 26 099 344 26 072 523 26 505 072 27 601 572 28 706 496 1.7

Compensation of employees 17 154 718 17 991 168 18 479 937 18 211 333 18 859 032 18 859 032 19 022 415 19 653 907 20 296 787 0.9

Goods and services 6 638 291 7 491 027 7 589 769 7 358 778 7 240 312 7 182 054 7 482 657 7 947 665 8 409 708 4.2

Interest and rent on land 24 527 55 426 4 684 – – 31 437 – – – (100.0)

Transfers and subsidies to: 957 621 1 028 660 332 597 285 358 589 646 634 381 270 569 311 129 337 028 (57.3)

Provinces and municipalities – – – – – – – – –

Departmental agencies and accounts 12 263 – 13 075 27 457 32 073 32 073 14 970 20 009 20 905 (53.3)

Higher education institutions – – – – – – – – –

Foreign governments and international organisations – – – – – – – – –

Public corporations and private enterprises – – – – – – – – –

Non-profit institutions 9 060 8 495 – 5 000 19 212 19 212 35 541 15 938 16 652 85.0

Households 936 298 1 020 165 319 522 252 901 538 361 583 096 220 058 275 182 299 471 (62.3)

Payments for capital assets 1 413 583 1 427 937 1 171 742 1 475 582 1 520 068 1 520 068 1 363 698 1 366 152 1 527 666 (10.3)

Buildings and other fixed structures 1 060 483 933 763 575 252 692 242 592 363 592 363 533 635 619 861 772 005 (9.9)

Machinery and equipment 353 100 494 174 596 490 783 340 927 705 927 705 830 063 746 291 755 661 (10.5)

Heritage Assets – – – – – – – – –

Specialised military assets – – – – – – – – –

Biological assets – – – – – – – – –

Land and sub-soil assets – – – – – – – – –

Software and other intangible assets – – – – – – – – –

Payments for financial assets – – – – – – – – –

Total economic classification 26 188 740 27 994 218 27 578 729 27 331 051 28 209 058 28 226 972 28 139 339 29 278 853 30 571 190 (0.3)

Tables 6 and 7 above shows the summary of payments and budget estimates per programme and

economic classification from 2019/20 to 2025/26.The total payments increased from R26.188 billion in

2019/20 to a revised estimate of R28.226 billion in 2022/23. In 2023/24, the budget is declining by

0.3 per cent from R28.226 billion in 2022/23 to R28.139 billion as a result of high revised estimate.

Compensation of employees shows an increase of 0.9 per cent from R18.859 billion to R19.022 billion in

2023/24 when compared to revised estimate as a result of PES formula and allocation for cost of living

adjsutments.

Good and Services show a positive growth of 4.2 per cent from R7.182 billion to R7.482 billion in 2023/24

when compared to the revised estimate due to additional funding to fund shortfalls in core items.

Transfers and subsidies show a negative growth of 57.3 per cent from R634.381 million to R270.569 million

when compared to the 2022/23 revised estimate due to high revised estimate as a result of payment of

medico legal claims.

Payments for capital assets show a negative growth of 10.3 per cent from R1.520 billion to R1.363 billion

when compared to the 2022/23 revised estimate due to high revised estimate.

164