Page 194 - Provincial Treasury Estimates.pdf

P. 194

Department: +HDOWK

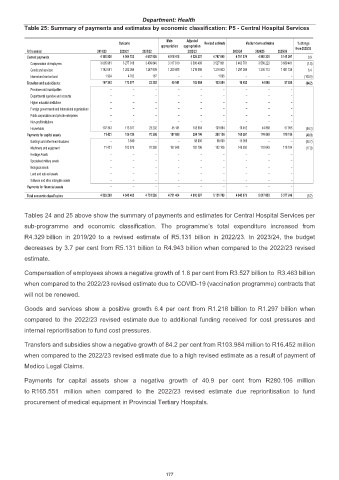

Table 25: Summary of payments and estimates by economic classification: P5 - Central Hospital Services

Main Adjusted

Outcome Revised estimate Medium-term estimates % change

appropriation appropriation

R thousand 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 from 2022/23

Current payments 4 150 526 4 564 702 4 657 936 4 518 415 4 526 307 4 747 699 4 761 070 4 802 336 5 141 207 0.3

Compensation of employees 3 005 961 3 277 916 3 409 840 3 317 810 3 306 409 3 527 801 3 463 701 3 566 223 3 689 481 (1.8)

Goods and services 1 142 641 1 282 084 1 247 909 1 200 605 1 219 898 1 218 803 1 297 369 1 236 113 1 451 726 6.4

Interest and rent on land 1 924 4 702 187 – – 1 095 – – – (100.0)

Transfers and subsidies to: 107 343 173 977 23 202 45 141 103 984 103 984 16 452 44 868 57 855 (84.2)

Provinces and municipalities – – – – – – – – –

Departmental agencies and accounts – – – – – – – – –

Higher education institutions – – – – – – – – –

Foreign governments and international organisations – – – – – – – – –

Public corporations and private enterprises – – – – – – – – –

Non-profit institutions – – – – – – – – –

Households 107 343 173 977 23 202 45 141 103 984 103 984 16 452 44 868 57 855 (84.2)

Payments for capital assets 71 421 106 724 70 388 187 848 280 106 280 106 165 551 170 649 178 184 (40.9)

Buildings and other fixed structures – 3 849 – – 98 000 98 000 15 959 – – (83.7)

Machinery and equipment 71 421 102 875 70 388 187 848 182 106 182 106 149 592 170 649 178 184 (17.9)

Heritage Assets – – – – – – – – –

Specialised military assets – – – – – – – – –

Biological assets – – – – – – – – –

Land and sub-soil assets – – – – – – – – –

Software and other intangible assets – – – – – – – – –

Payments for financial assets – – – – – – – – –

Total economic classification 4 329 290 4 845 403 4 751 526 4 751 404 4 910 397 5 131 789 4 943 073 5 017 853 5 377 246 (3.7)

Tables 24 and 25 above show the summary of payments and estimates for Central Hospital Services per

sub-programme and economic classification. The programme’s total expenditure increased from

R4.329 billion in 2019/20 to a revised estimate of R5.131 billion in 2022/23. In 2023/24, the budget

decreases by 3.7 per cent from R5.131 billion to R4.943 billion when compared to the 2022/23 revised

estimate.

Compensation of employees shows a negative growth of 1.8 per cent from R3.527 billion to R3.463 billion

when compared to the 2022/23 revised estimate due to COVID-19 (vaccination programme) contracts that

will not be renewed.

Goods and services show a positive growth 6.4 per cent from R1.218 billion to R1.297 billion when

compared to the 2022/23 revised estimate due to additional funding received for cost pressures and

internal reprioritisation to fund cost pressures.

Transfers and subsidies show a negative growth of 84.2 per cent from R103.984 million to R16.452 million

when compared to the 2022/23 revised estimate due to a high revised estimate as a result of payment of

Medico Legal Claims.

Payments for capital assets show a negative growth of 40.9 per cent from R280.106 million

to R165.551 million when compared to the 2022/23 revised estimate due reprioritisation to fund

procurement of medical equipment in Provincial Tertiary Hospitals.

177