Page 449 - Provincial Treasury Estimates.pdf

P. 449

Estimates of the Provincial Revenue and Expenditure (EPRE) – 2023/24 Financial Year

6. 6. Receipts and financing

6.1 Summary of receipts

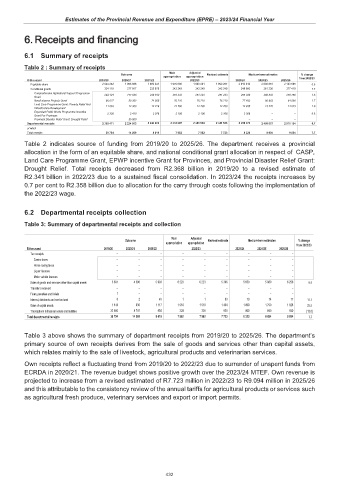

Table 2 : Summary of receipts

Main Adjusted

Outcome Revised estimate Medium-term estimates % change

appropriation appropriation

R thousand 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 from 2022/23

Equitable share 2 044 352 1 956 666 1 909 241 1 976 698 1 999 281 1 999 287 2 010 316 2 098 851 2 193 685 0.6

Conditional grants 324 119 277 917 335 679 342 249 342 249 342 249 348 060 361 236 377 419 1.7

Comprehensive Agricultural Support Programme 244 101 177 836 246 610 251 233 251 233 251 233 255 336 266 803 278 756 1.6

Grant

Ilima/Letsema Projects Grant 66 627 50 362 74 565 76 210 76 210 76 210 77 483 80 963 84 590 1.7

Land Care Programme Grant: Poverty Relief And 11 063 12 309 12 428 12 700 12 700 12 700 12 935 13 470 14 073 1.9

Infrastructure Development

Expanded Public Works Programme Incentive 2 328 2 410 2 076 2 106 2 106 2 106 2 306 – – 9.5

Grant For Provinces

Provincial Disaster Relief Grant: Drought Relief 35 000 – – –

Departmental receipts 2 368 471 2 234 583 2 244 920 2 318 947 2 341 530 2 341 536 2 358 376 2 460 087 2 571 104 0.7

of which

Total receipts 39 794 14 069 8 019 7 962 7 962 7 723 8 320 8 694 9 094 7.7

Table 2 indicates source of funding from 2019/20 to 2025/26. The department receives a provincial

allocation in the form of an equitable share, and national conditional grant allocation in respect of CASP,

Land Care Programme Grant, EPWP incentive Grant for Provinces, and Provincial Disaster Relief Grant:

Drought Relief. Total receipts decreased from R2.368 billion in 2019/20 to a revised estimate of

R2.341 billion in 2022/23 due to a sustained fiscal consolidation. In 2023/24 the receipts increases by

0.7 per cent to R2.358 billion due to allocation for the carry through costs following the implementation of

the 2022/23 wage.

6.2 Departmental receipts collection

Table 3: Summary of departmental receipts and collection

Main Adjusted

Outcome Revised estimate Medium-term estimates % change

appropriation appropriation

from 2022/23

R thousand 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26

Tax receipts – – – – – – – – –

Casino taxes – – – – – – – – –

Horse racing taxes – – – – – – – – –

Liquor licences – – – – – – – – –

Motor vehicle licences – – – – – – – – –

Sales of goods and services other than capital assets 5 691 4 396 5 903 6 223 6 223 5 306 5 650 5 980 6 259 6.5

Transfers received – – – – – – – – –

Fines, penalties and forfeits 1 – – – – – – – –

Interest, dividends and rent on land 8 2 45 1 1 63 70 74 77 11.1

Sales of capital assets 1 614 930 1 117 1 510 1 510 1 434 1 800 1 750 1 828 25.5

Transactions in financial assets and liabilities 32 480 8 741 954 228 228 920 800 890 930 (13.0)

Total departmental receipts 39 794 14 069 8 019 7 962 7 962 7 723 8 320 8 694 9 094 7.7

Table 3 above shows the summary of department receipts from 2019/20 to 2025/26. The department’s

primary source of own receipts derives from the sale of goods and services other than capital assets,

which relates mainly to the sale of livestock, agricultural products and veterinarian services.

Own receipts reflect a fluctuating trend from 2019/20 to 2022/23 due to surrender of unspent funds from

ECRDA in 2020/21. The revenue budget shows positive growth over the 2023/24 MTEF. Own revenue is

projected to increase from a revised estimated of R7.723 million in 2022/23 to R9.094 million in 2025/26

and this attributable to the consistency review of the annual tariffs for agricultural products or services such

as agricultural fresh produce, veterinary services and export or import permits.

432