Page 80 - Provincial Treasury Estimates.pdf

P. 80

Overview of the Provincial Revenue and Expenditure (OPRE) Financial Year 2023/24

x Provincial Treasury is projecting to spend R1.424 billion over the 2023 MTEF. In 2023/24, the

allocation increases by 11.1 per cent to R454.989 million. Included in the allocations is the additional

funding provided by the province of R11.531 million and R34.399 over the 2023 MTEF for the medico

legal claims intervention at Health department; and R12.605 million in 2024/25 and R17.662 million in

2025/26 for the additional posts. Additionally, there are funds rescheduled from 2022/23, which include

R4.2 million for the ICT switch infrastructure and R2.529 million for the technical capacity for

infrastructure delivery to 2023/24 as well as R5.622 million for the municipal interventions to 2025/26.

Furthermore, R6.027 million is allocated in 2025/26 for the carry through costs of the funding provided

in the 2020 MTEF for Compensation of employees.

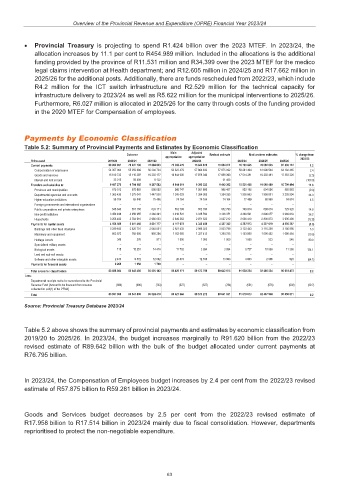

Payments by Economic Classification

Table 5.2: Summary of Provincial Payments and Estimates by Economic Classification

Main Adjusted

Outcome Revised estimate Medium-term estimates % change from

appropriation appropriation

R thousand 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 2022/23

Current payments 69 992 951 70 431 796 72 604 023 73 366 479 75 842 978 75 864 911 76 795 845 78 092 025 81 565 712 1.2

Compensation of employees 54 357 004 55 259 689 56 204 724 56 522 479 57 864 632 57 875 032 59 281 464 61 698 544 64 182 485 2.4

Goods and services 15 610 732 15 115 297 16 393 177 16 844 000 17 978 346 17 958 390 17 514 381 16 393 481 17 383 226 (2.5)

Interest and rent on land 25 215 56 809 6 122 – – 31 488 – – – (100.0)

Transfers and subsidies to: 9 497 276 9 704 185 9 287 583 8 944 619 9 390 323 9 440 362 10 531 466 10 089 480 10 790 494 11.6

Provinces and municipalities 815 513 870 665 886 082 906 747 1 001 686 995 487 902 198 854 086 865 983 (9.4)

Departmental agencies and accounts 1 363 439 1 375 041 1 447 530 1 245 029 1 354 365 1 354 335 1 955 863 1 958 801 2 205 994 44.4

Higher education institutions 58 704 65 840 75 486 74 164 74 164 74 164 77 489 80 969 84 674 4.5

–

Foreign governments and international organisations – – – – – – – –

Public corporations and private enterprises 546 643 557 168 624 171 652 793 652 793 652 793 749 914 698 674 729 320 14.9

Non-profit institutions 3 456 496 4 050 955 3 268 291 3 416 523 3 335 792 3 336 371 4 209 591 3 696 077 3 969 033 26.2

Households 3 256 482 2 784 516 2 986 023 2 649 363 2 971 523 3 027 212 2 636 410 2 800 873 2 935 490 (12.9)

Payments for capital assets 4 105 509 3 411 456 3 631 777 4 117 073 4 340 498 4 337 342 4 292 913 4 227 019 4 295 267 (1.0)

Buildings and other fixed structures 3 299 643 2 620 701 2 648 001 2 921 433 2 996 023 3 023 799 3 123 443 3 116 209 3 186 956 3.3

Machinery and equipment 802 972 765 656 956 294 1 162 065 1 327 413 1 294 755 1 153 950 1 096 402 1 095 454 (10.9)

Heritage Assets 345 276 971 1 000 1 000 1 000 1 800 523 546 80.0

Specialised military assets – – – – – – – –

–

Biological assets 115 15 251 14 419 11 702 3 894 3 894 8 727 10 889 11 388 124.1

–

Land and sub-soil assets – – – – – – – –

Software and other intangible assets 2 433 9 572 12 092 20 874 12 168 13 893 4 993 2 996 923 (64.1)

–

Payments for financial assets 2 268 1 050 1 760 – – – – –

Total economic classification 83 598 004 83 548 486 85 525 143 86 428 171 89 573 799 89 642 615 91 620 224 92 408 524 96 651 473 2.2

Less:

Departmental receipts not to be surrendered to the Provincial

Revenue Fund [Amount to be financed from revenue (696) (686) (733) (527) (527) (784) (551) (576) (602) (29.7)

collected ito s22(1) of the PFMA]

Total 83 597 308 83 547 800 85 524 410 86 427 644 89 573 272 89 641 831 91 619 673 92 407 948 96 650 871 2.2

Source: Provincial Treasury Database 2023/24

Table 5.2 above shows the summary of provincial payments and estimates by economic classification from

2019/20 to 2025/26. In 2023/24, the budget increases marginally to R91.620 billion from the 2022/23

revised estimate of R89.642 billion with the bulk of the budget allocated under current payments at

R76.795 billion.

In 2023/24, the Compensation of Employees budget increases by 2.4 per cent from the 2022/23 revised

estimate of R57.875 billion to R59.281 billion in 2023/24.

Goods and Services budget decreases by 2.5 per cent from the 2022/23 revised estimate of

R17.958 billion to R17.514 billion in 2023/24 mainly due to fiscal consolidation. However, departments

reprioritised to protect the non-negotiable expenditure.

63