Page 20 - Estimates of Public Entities Revenue & Expenditure 2023

P. 20

PROVINCE OF THE EASTERN CAPE ESTIMATES OF PUBLIC ENTITIES REVENUE AND EXPENDITURE 2023/24

9. Expenditure estimates

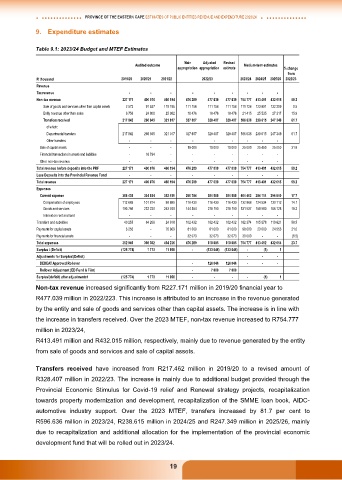

Table 9.1: 2023/24 Budget and MTEF Estimates

Audited outcome Main Adjusted Revised Medium-term estimates

appropriation appropriation estimate % change

from

R thousand 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 2022/23

Revenue

Tax revenue - - - - - - - - -

Non-tax revenue 227 171 400 076 466 194 476 289 477 039 477 039 754 777 413 491 432 015 58.2

Sale of goods and services other than capital assets 2 573 91 537 119 195 111 156 111 156 111 156 111 726 123 891 132 299 0.5

Entity revenue other than sales 6 756 24 800 25 982 18 476 18 476 18 476 21 415 25 535 27 317 15.9

Transfers received 217 842 266 945 321 017 327 657 328 407 328 407 596 636 238 615 247 349 81.7

of which:

Departmental transfers 217 842 266 945 321 017 327 657 328 407 328 407 596 636 238 615 247 349 81.7

Other transfers - - - - - - - - -

Sale of capital assets - - - 19 000 19 000 19 000 25 000 25 450 25 050 31.6

Financial transactions in assets and liabilities - 16 794 - - - - - - -

Other non-tax revenue - - - - - - - - -

Total revenue before deposits into the PRF 227 171 400 076 466 194 476 289 477 039 477 039 754 777 413 491 432 015 58.2

Less Deposits into the Provincial Revenue Fund - - - - - - - - -

Total revenue 227 171 400 076 466 194 476 289 477 039 477 039 754 777 413 491 432 015 58.2

Expenses

Current expense 306 435 334 034 352 455 260 784 394 580 394 580 464 403 284 114 296 840 17.7

Compensation of employees 112 669 101 814 98 695 116 430 116 430 116 430 132 866 124 534 130 112 14.1

Goods and services 193 766 232 220 253 760 144 354 278 150 278 150 331 537 159 580 166 728 19.2

Interest on rent and land - - - - - - - - -

Transfers and subsidies 40 255 64 268 24 918 102 432 102 432 102 432 162 374 105 878 110 621 58.5

Payments for capital assets 6 255 - 76 863 81 000 81 000 81 000 98 000 23 500 24 553 21.0

Payments for financial assets - - - 32 073 32 073 32 073 30 000 - - (6.5)

Total expenses 352 945 398 302 454 236 476 289 610 085 610 085 754 777 413 492 432 014 23.7

Surplus / (Deficit) (125 774) 1 773 11 958 - (133 046) (133 046) - (1) 1

Adjustments for Surplus/(Deficit) - - -

DEDEAT Approved Rollover - 126 046 126 046 - - -

Rollover Adjustment (ED Fund & Film) - 7 000 7 000

Surplus/(deficit) after adjustments1 (125 774) 1 773 11 958 - - - - (1) 1

Non-tax revenue increased significantly from R227.171 million in 2019/20 financial year to

R477.039 million in 2022/223. This increase is attributed to an increase in the revenue generated

by the entity and sale of goods and services other than capital assets. The increase is in line with

the increase in transfers received. Over the 2023 MTEF, non-tax revenue increased to R754.777

million in 2023/24,

R413.491 million and R432.015 million, respectively, mainly due to revenue generated by the entity

from sale of goods and services and sale of capital assets.

Transfers received have increased from R217.462 million in 2019/20 to a revised amount of

R328.407 million in 2022/23. The increase is mainly due to additional budget provided through the

Provincial Economic Stimulus for Covid-19 relief and Renewal strategy projects, recapitalization

towards property modernization and development, recapitalization of the SMME loan book, AIDC-

automotive industry support. Over the 2023 MTEF, transfers increased by 81.7 per cent to

R596.636 million in 2023/24, R238.615 million in 2024/25 and R247.349 million in 2025/26, mainly

due to recapitalization and additional allocation for the implementation of the provincial economic

development fund that will be rolled out in 2023/24.

19