Page 43 - Estimates of Public Entities Revenue & Expenditure 2023

P. 43

PROVINCE OF THE EASTERN CAPE ESTIMATES OF PUBLIC ENTITIES REVENUE AND EXPENDITURE 2023/24

• Implementation of craft and visual arts flagship projects and marketing of visual art and crafts

entrepreneurs.

• Continue with the documentation of indigenous knowledge systems.

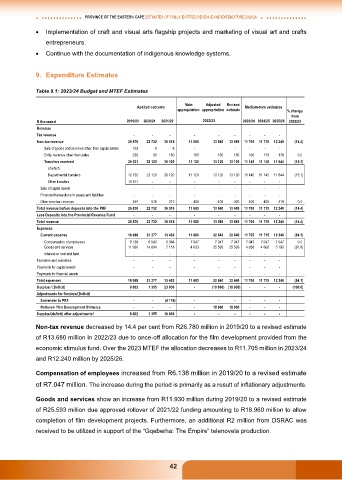

9. Expenditure Estimates

Table 9.1: 2023/24 Budget and MTEF Estimates

Audited outcome Main Adjusted Revised Medium-term estimates

appropriation appropriation estimate % change

from

R thousand 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 2022/23

Revenue

Tax revenue - - - - - - - - -

Non-tax revenue 26 870 22 732 36 518 11 680 13 680 13 680 11 705 11 715 12 240 (14.4)

Sale of goods and services other than capital assets 103 6 6 - - - - - -

Entity revenue other than sales 239 90 180 160 160 160 160 170 178 0.0

Transfers received 26 031 22 120 36 120 11 120 13 120 13 120 11 145 11 145 11 644 (15.1)

of which:

Departmental transfers 12 720 22 120 36 120 11 120 13 120 13 120 11 145 11 145 11 644 (15.1)

Other transfers 13 311 - - - - - - - -

Sale of capital assets - - - - - - - - -

Financial transactions in assets and liabilities - - - - - - - - -

Other non-tax revenue 497 516 212 400 400 400 400 400 418 0.0

Total revenue before deposits into the PRF 26 870 22 732 36 518 11 680 13 680 13 680 11 705 11 715 12 240 (14.4)

Less Deposits into the Provincial Revenue Fund - - - - - - - - -

Total revenue 26 870 22 732 36 518 11 680 13 680 13 680 11 705 11 715 12 240 (14.4)

Expenses

Current expense 18 068 21 377 13 482 11 680 32 640 32 640 11 705 11 715 12 240 (64.1)

Compensation of employees 6 138 6 543 6 364 7 047 7 047 7 047 7 047 7 047 7 047 0.0

Goods and services 11 930 14 834 7 118 4 633 25 593 25 593 4 658 4 668 5 193 (81.8)

Interest on rent and land - - - - - - - - -

Transfers and subsidies - - - - - - - - -

Payments for capital assets - - - - - - - - -

Payments for financial assets - - - - - - - - -

Total expenses 18 068 21 377 13 482 11 680 32 640 32 640 11 705 11 715 12 240 (64.1)

Surplus / (Deficit) 8 802 1 355 23 036 - (18 960) (18 960) - - - (100.0)

Adjustments for Surplus/(Deficit)

Surrender to PRF - - (4 176) - - - - - -

Rollover- Film Development Stimulus - - - - 18 960 18 960 - - -

Surplus/(deficit) after adjustments1 8 802 1 355 18 860 - - - - - -

Non-tax revenue decreased by 14.4 per cent from R26.780 million in 2019/20 to a revised estimate

of R13.680 million in 2022/23 due to once-off allocation for the film development provided from the

economic stimulus fund. Over the 2023 MTEF the allocation decreases to R11.705 million in 2023/24

and R12.240 million by 2025/26.

Compensation of employees increased from R6.138 million in 2019/20 to a revised estimate

of R7.047 million. The increase during the period is primarily as a result of inflationary adjustments.

Goods and services show an increase from R11.930 million during 2019/20 to a revised estimate

of R25.593 million due approved rollover of 2021/22 funding amounting to R18.960 million to allow

completion of film development projects. Furthermore, an additional R2 million from DSRAC was

received to be utilized in support of the “Gqeberha: The Empire” telenovela production.

42