Page 68 - Estimates of Public Entities Revenue & Expenditure 2023

P. 68

PROVINCE OF THE EASTERN CAPE ESTIMATES OF PUBLIC ENTITIES REVENUE AND EXPENDITURE 2023/24

• Implementation of High Transmission Areas programme in the Eastern Cape Province and the

implementation of the Undetectable is equal to Untransmitable (U=U) campaign in the Eastern

Cape Province

• Socio-economic Compacts / accords through the Development Convention

• Innovative organisational maturity modelling

9. Expenditure estimates

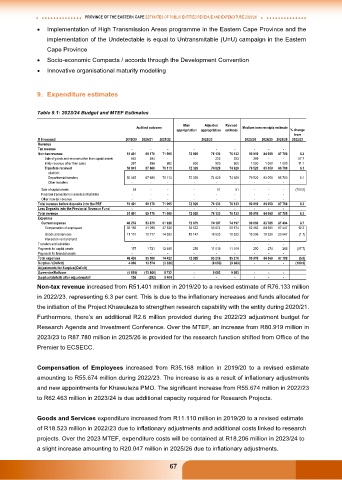

Table 9.1: 2023/24 Budget and MTEF Estimates

Main Adjusted Revised

Audited outcome Medium-term receipts estimate

appropriation appropriation estimate % change

from

R thousand 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 2022/23

Revenue

Tax revenue - - - - - - - - -

Non-tax revenue 51 401 69 170 71 095 72 929 76 133 76 133 80 919 84 059 87 780 6.3

Sale of goods and services other than capital assets 945 594 - - 253 253 399 - - 57.7

Entity revenue other than sales 387 896 982 600 900 900 1 000 1 000 1 000 11.1

Transfers received 50 045 67 680 70 113 72 329 74 929 74 929 79 520 83 059 86 780 6.1

of which:

Departmental transfers 50 045 67 680 70 113 72 329 74 929 74 929 79 520 83 059 86 780 6.1

Other transfers - - - - - - - - -

Sale of capital assets 24 - - - 51 51 - - - (100.0)

Financial transactions in assets and liabilities - - - - - - - - -

Other non-tax revenue - - - - - - - - -

Total revenue before deposits into the PRF 51 401 69 170 71 095 72 929 76 133 76 133 80 919 84 059 87 780 6.3

Less Deposits into the Provincial Revenue Fund - - - - - - - - -

Total revenue 51 401 69 170 71 095 72 929 76 133 76 133 80 919 84 059 87 780 6.3

Expenses - - - - - - - - -

Current expense 46 278 53 875 61 928 72 679 74 197 74 197 80 669 83 785 87 494 8.7

Compensation of employees 35 168 41 098 47 536 54 532 55 674 55 674 62 463 64 555 67 447 12.2

Goods and services 11 110 12 777 14 392 18 147 18 523 18 523 18 206 19 230 20 047 (1.7)

Interest on rent and land - - - - - - - - -

Transfers and subsidies - - - - - - - - -

Payments for capital assets 157 1 721 12 495 250 11 019 11 019 250 274 286 (97.7)

Payments for financial assets - - - - - - - - -

Total expenses 46 435 55 596 74 423 72 929 85 216 85 216 80 919 84 059 87 780 (5.0)

Surplus / (Deficit) 4 966 13 574 (3 328) - (9 083) (9 083) - - - (100.0)

Adjustments for Surplus/(Deficit)

Surrender/Rollover (4 810) (13 866) 8 732 - 9 083 9 083 - - -

Surplus/(deficit) after adjustments1 156 (292) 5 404 - - - - - -

Non-tax revenue increased from R51.401 million in 2019/20 to a revised estimate of R76.133 million

in 2022/23, representing 6.3 per cent. This is due to the inflationary increases and funds allocated for

the initiation of the Project Khawuleza to strengthen research capability with the entity during 2020/21.

Furthermore, there’s an additional R2.6 million provided during the 2022/23 adjustment budget for

Research Agenda and Investment Conference. Over the MTEF, an increase from R80.919 million in

2023/23 to R87.780 million in 2025/26 is provided for the research function shifted from Office of the

Premier to ECSECC.

Compensation of Employees increased from R35.168 million in 2019/20 to a revised estimate

amounting to R55.674 million during 2022/23. The increase is as a result of inflationary adjustments

and new appointments for Khawuleza PMO. The significant increase from R55.674 million in 2022/23

to R62.463 million in 2023/24 is due additional capacity required for Research Projects.

Goods and Services expenditure increased from R11.110 million in 2019/20 to a revised estimate

of R18.523 million in 2022/23 due to inflationary adjustments and additional costs linked to research

projects. Over the 2023 MTEF, expenditure costs will be contained at R18.206 million in 2023/24 to

a slight increase amounting to R20.047 million in 2025/26 due to inflationary adjustments.

67