Page 26 - Provincial Treasury Estimates.pdf

P. 26

Overview of the Provincial Revenue and Expenditure (OPRE) Financial Year 2023/24

Construction

Following a period of prolonged decline, the sector is beginning to show signs of recovery due to increased capital

outlays and infrastructure expenditure by government. By end of quarter 3 2022, construction activity in the Province

is estimated to have increased by 3.1 per cent quarter on quarter following an acceleration in construction works in

that quarter. Building activities for residential and non-residential purposes, however, has remained comparatively

subdued in the Province see Table 1.4.

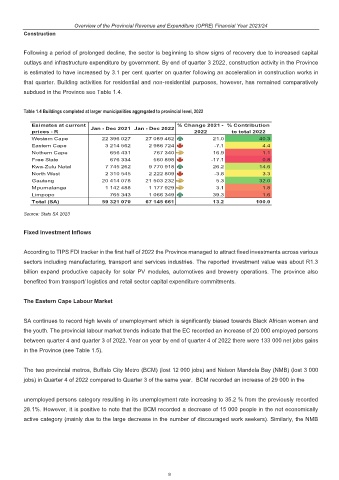

Table 1.4 Buildings completed at larger municipalities aggregated to provincial level, 2022

Esimates at current Jan - Dec 2021 Jan - Dec 2022 % Change 2021 - % Contribution

prices - R 2022 to total 2022

Western Cape 22 396 027 27 089 462 21.0 40.3

Eastern Cape 3 214 562 2 986 724 -7.1 4.4

Nothern Cape 656 431 767 340 16.9 1.1

Free State 676 334 560 898 -17.1 0.8

Kwa-Zulu Natal 7 745 262 9 770 918 26.2 14.6

North West 2 310 545 2 222 809 -3.8 3.3

Gauteng 20 414 078 21 503 232 5.3 32.0

Mpumalanga 1 142 488 1 177 929 3.1 1.8

Limpopo 765 343 1 066 349 39.3 1.6

Total (SA) 59 321 070 67 145 661 13.2 100.0

Source: Stats SA 2023

Fixed Investment Inflows

According to TIPS FDI tracker in the first half of 2022 the Province managed to attract fixed investments across various

sectors including manufacturing, transport and services industries. The reported investment value was about R1.3

billion expand productive capacity for solar PV modules, automotives and brewery operations. The province also

benefited from transport/ logistics and retail sector capital expenditure commitments.

The Eastern Cape Labour Market

SA continues to record high levels of unemployment which is significantly biased towards Black African women and

the youth. The provincial labour market trends indicate that the EC recorded an increase of 20 000 employed persons

between quarter 4 and quarter 3 of 2022. Year on year by end of quarter 4 of 2022 there were 133 000 net jobs gains

in the Province (see Table 1.5).

The two provincial metros, Buffalo City Metro (BCM) (lost 12 000 jobs) and Nelson Mandela Bay (NMB) (lost 3 000

jobs) in Quarter 4 of 2022 compared to Quarter 3 of the same year. BCM recorded an increase of 29 000 in the

unemployed persons category resulting in its unemployment rate increasing to 35.2 % from the previously recorded

28.1%. However, it is positive to note that the BCM recorded a decrease of 15 000 people in the not economically

active category (mainly due to the large decrease in the number of discouraged work seekers). Similarly, the NMB

9