Page 36 - Provincial Treasury Estimates.pdf

P. 36

Overview of the Provincial Revenue and Expenditure (OPRE) Financial Year 2023/24

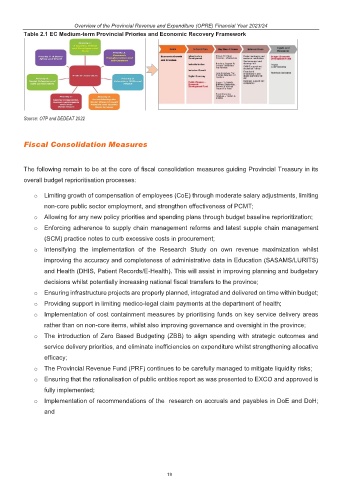

Table 2.1 EC Medium-term Provincial Priories and Economic Recovery Framework

Source: OTP and DEDEAT 2022

Fiscal Consolidation Measures

The following remain to be at the core of fiscal consolidation measures guiding Provincial Treasury in its

overall budget reprioritisation processes:

o Limiting growth of compensation of employees (CoE) through moderate salary adjustments, limiting

non-core public sector employment, and strengthen effectiveness of PCMT;

o Allowing for any new policy priorities and spending plans through budget baseline reprioritization;

o Enforcing adherence to supply chain management reforms and latest supple chain management

(SCM) practice notes to curb excessive costs in procurement;

o Intensifying the implementation of the Research Study on own revenue maximization whilst

improving the accuracy and completeness of administrative data in Education (SASAMS/LURITS)

and Health (DHIS, Patient Records/E-Health). This will assist in improving planning and budgetary

decisions whilst potentially increasing national fiscal transfers to the province;

o Ensuring infrastructure projects are properly planned, integrated and delivered on time within budget;

o Providing support in limiting medico-legal claim payments at the department of health;

o Implementation of cost containment measures by prioritising funds on key service delivery areas

rather than on non-core items, whilst also improving governance and oversight in the province;

o The introduction of Zero Based Budgeting (ZBB) to align spending with strategic outcomes and

service delivery priorities, and eliminate inefficiencies on expenditure whilst strengthening allocative

efficacy;

o The Provincial Revenue Fund (PRF) continues to be carefully managed to mitigate liquidity risks;

o Ensuring that the rationalisation of public entities report as was presented to EXCO and approved is

fully implemented;

o Implementation of recommendations of the research on accruals and payables in DoE and DoH;

and

19